New era, new data: Why ‘financial inclusion 2.0’ will require a different approach to measurement

New era, new data: Why ‘financial inclusion 2.0’ will require a different approach to measurement

5 May, 2020 •Financial inclusion is entering a new era

The movement’s first era – which we’ll call “Financial Inclusion 1.0” – lasted from 2000 to 2019. During that time, the data tools employed to measure, track and guide financial inclusion efforts were effective in putting the sector firmly on the global development agenda. This data made the invisible visible, helped increase access to finance, aided financial inclusion policy development and produced better financial products for the underserved and poor. The focus during this period was on individuals and their immediate households, which was reflected in the data that was collected. The primary outcome of this phase was financial inclusion, almost exclusively for its own sake.

However, it is not clear to what extent Financial Inclusion 1.0, by extending formal finance to more people, has reduced poverty and improved people’s lives or wellbeing. Just under 2 billion people are still not banked and integrated into the formal financial sector, poverty levels remain stubbornly high, and there is still large inequality across all resource types. The question we need to ask ourselves is how, as financial sector development practitioners, we can approach our work differently to better serve the poor through financial services, so that we have a greater impact on reducing poverty and increasing wellbeing.

Some analysts suggest that the pathways to poverty reduction work through two mechanisms; a resilience pathway, which ameliorates and manages the effects of shocks to individuals and households, and an opportunity pathway, which can generate new prospects for income and employment. But during the years of Financial Inclusion 1.0, the mechanisms underlying these pathways were not well-defined – and we were therefore ineffective in bringing about real economic outcomes, specifically through the opportunity pathway. It can be argued that some progress was made on the resilience pathway, but its impacts on poverty reduction and broader social outcomes (like the SDGs) have been weak. It’s becoming clear that the sector needs to move into a new era – one defined by greater impact across the board: the era of Financial Inclusion 2.0 (FI2.0).

Understanding financial inclusion 2.0

This new era will necessitate a rethink of the role financial sector development can play in bringing about real economic outcomes that lead to poverty reduction and greater wellbeing. The current thinking is that practitioners, who previously focused on increasing inclusion, should pivot their efforts towards activities that have more direct links to the real economy (i.e.: the opportunity pathway), such as employment and income growth – while working to strengthen the financial sector’s intersection with real economy activities.

So, how can access and use of appropriate financial services directly support real economy activities that have a larger impact on poverty reduction and broader social outcomes? The overarching goal of making financial markets work for the poor remains as relevant as ever for us at FinMark Trust, but to achieve it – while positively impacting poverty and broader SDG objectives among individuals and micro, small and medium enterprises (MSMEs) – we’ll need to take a new approach to data.

As we move toward FI2.0, the data tools that were appropriate for FI1.0 might not serve us well as we chart this new territory. That’s not to say the current tools should just fall away: They are still very relevant and useful, especially for the resilience pathway. But they will need to be adapted, and new methods, data sources and analytical frameworks will need to be adopted to place the data emphasis firmly on the opportunity/real economy pathway, and on other inclusive aspects of FI2.0. This new era requires that we become even more evidence-based in regards to our frameworks and that our data tools become more nuanced to support the change we desire.

New relevant indicators are needed

Importantly, new indicators that speak to the outcomes of FI2.0 need to be developed, so that we can track progress and modify our plans as required. What we measure is usually embedded in our theories of change, which influences the logframes, monitoring and evaluation dashboards, and specific research questions we have. The output of this measurement is usually an indicator, index or estimate of some aspect of the impact we are interested in making.

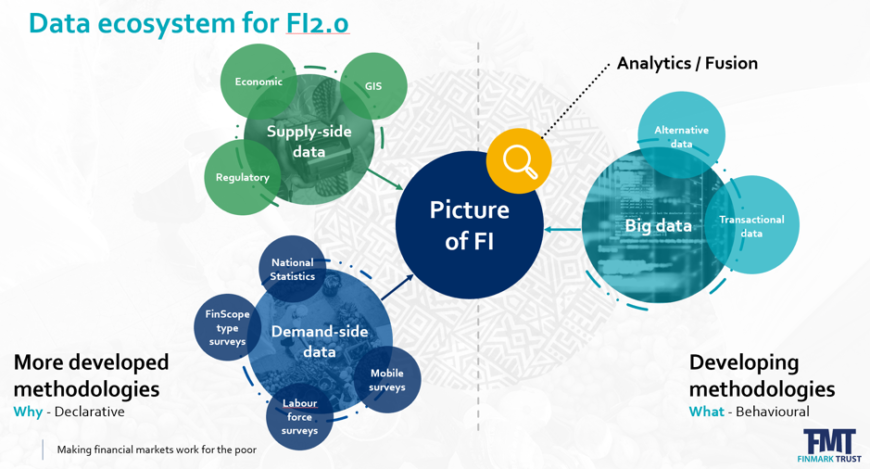

In research during the years of FI1.0, when inclusion was the main impact goal, a typical indicator would be the percentage of a population that was within two kilometres of an ATM, or the number of banked people in a population. In contrast, a FI2.0 indicator could possibly be the percentage of total credit that is extended to women-owned MSME’s in a specific region, the number of jobs created through a specific intervention, or the percentage of people using a credit card or informal mechanism to deal with a specific shock, to cite just a few examples. As financial sector development practitioners, we will need to agree on and define these together. But one thing is certain: Multiple data sources will be required to populate these indicators. A rich data ecosystem as pictured below will be needed to support this.

Different needs, different data

A logical consequence of FI2.0 is that we need to focus more on high-leverage MSMEs and the agriculture industry, as they are the engines of the real economy. This will require more emphasis on MSME and agricultural data, such as the FinScope MSME and FinScope Agri surveys. We will need to be able to analyse this data by sector and type of value chain activity. At FinMark Trust, we have already begun work on a new measurement framework for these surveys. At a methodological level, we are investigating the use of geospatial layers (i.e.: data sets that are geospatially coded to highlight proximity to hospitals, schools, ATMs and other points of interest) to assist us in drawing better MSME samples than those produced by current methodologies. This new method will allow us to sample from high-concentration business areas that will produce a better spread of enterprises. This is one example of how we need to evolve our tools to meet the data needs of FI2.0.

In some cases, where specific sectors are of interest, a comprehensive bespoke employer survey might be required to fully understand the constraints and opportunities for employment, income growth, skills, etc. Labour force surveys will need to be consulted on a regular basis to provide a departure point for understanding where interventions might be needed. By the same token, businesses censuses will be a valuable source of data where they exist and, in some cases, will need to be initiated in data-poor markets.

In addition to this, we will need to access non-survey data, such as the amount of credit extended to MSMEs or to the agri-industry overall – and also data within sectors, and about vulnerable groups such as women, the youth and rural populations. Supply-side systems will need to be modified to capture this level of disaggregation, to support the drive to make economies and financial services more inclusive.

The evolution of the Finscope survey

When it comes to consumer surveys such as FinMark Trust’s FinScope, we need to add modules that speak to employment activity, education and skills, as well as access to and use of basic services such as education, healthcare, energy and sanitation. This will help us to start unpacking the links between financial sector offerings and what people really need to prosper in their lives. As an example, FinMark Trust has recently extended the employment module in our South African FinScope survey to explore the nature of how people work.

We know that access should not be the final yardstick to measure success in FI2.0: Instead, success is predicated on understanding which financial tools are most appropriate to meet customers’ financial needs. For this purpose, we have integrated the FinNeeds framework, developed by the insight2impact facility, into our surveys. Financial health is another key goal of FI2.0, and it also needs to play a more prominent role in our surveys and analytics.

A core aspect of FI2.0 is moving beyond simply looking at poverty, and assessing human development outcomes more broadly – as so eloquently captured in the SDG’s. The FinScope surveys will give us an indication of how we are progressing on some of these outcomes – specifically as they pertain to access to basic services. Modules for health, education, sanitation, green energy and more are being incorporated into our surveys.

New data sources and analytics

In FI2.0, we have a whole host of new data sources available to us, such as financial sector transactional data, mobile call detail records, social media activity and other types of big data, which can give us new insights into how people behave or feel. From a financial inclusion perspective, we are still in the early stages of understanding how this data can benefit our work. But some success has already been achieved in using social media data and mobile call records to support credit scoring models, thereby making credit more accessible.

However, having this plethora of data in and of itself is not valuable. The true value lies in being able to integrate it, analyse it and draw meaningful insights from it. That’s why FinMark Trust will be developing new conceptual frameworks, statistical methods and approaches to extract insights from our new data, to support better decision making. A particular focus will be to understand the intersectionality of different segment characteristics that drive financial behaviour – e.g.: youth, marital status, employment status, etc. We need to get better at identifying how contextual variables determine the impact of financial services on people’s lives. We will also be looking at how this new data can be better visualised and disseminated in a world that is overloaded with information. Our data portal currently provides an entry point into a vast array of survey and geographic information system data sets that can be analysed using our interactive data tools.

Data sustainability: Low-cost data collection

As we move into a world where FI2.0 is a reality, there will be a need for more data that is available cheaper and faster, as this will allow us to pivot our strategies and plans quickly when necessary. This will be useful in formulating rapid responses to environmental changes and disruptions, such as natural disasters and pandemics like COVID-19. To that end, FinMark Trust has been developing a low-cost and sustainable data collection offering, using mixed mode data collection and statistical modeling to produce reliable estimates of headline indicators for monitoring and evaluation purposes that complement the larger, less regular FinScope-type surveys. There are many other use cases for this methodology that can serve the data needs of FI2.0 practitioners. We have piloted the collection of digital financial indictors in eight countries and are concluding a gender-focused pilot in four countries. Early results are positive, with the method yielding estimates comparable to those collected by traditional in-person surveys.

Creating a new set of indicators, measurement frameworks, data tools and analytic approaches cannot happen in isolation. It will take a network of collaborators to pull this off. To create this network, a collaborative data programme is being established within the FSD Network, under the auspices of FSD Africa and through funding provided by DFID. This group intends to develop these new approaches to support FI2.0 in Africa.

Efforts like these will be essential in building momentum, as the FI2.0 era progresses. As we look toward the many challenges and opportunities these years will bring, it will be important to ensure that the data we gather – and the initiatives we build – maintain our focus on how appropriate financial services can directly support real economic opportunity. If we do, the anti-poverty impact of this new era of financial inclusion is likely to be far more significant than that of the previous era.

Grant Robertson is insight2impact’s Head of Survey & GIS Data for Financial Inclusion (Data4FI).

This article was first published on Next Billion as part of the Openi2i series.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.