Data science: A challenging career with incredible potential for a financially inclusive Africa

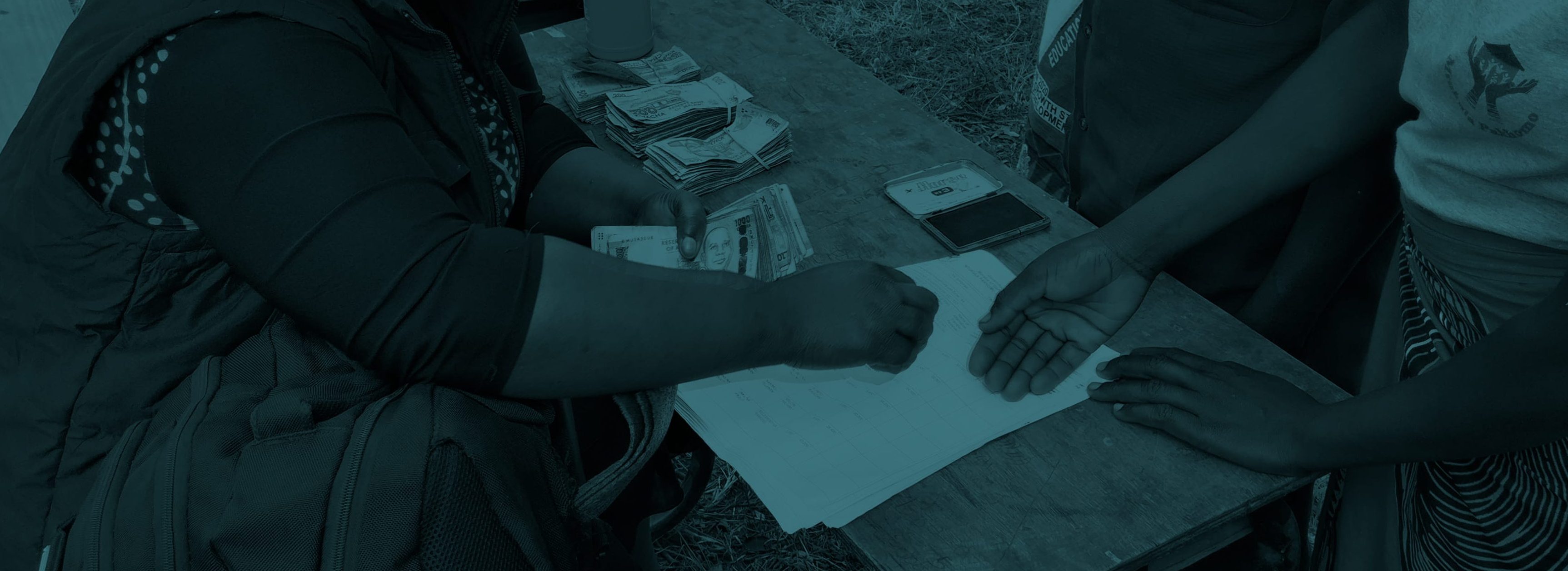

Despite the increasing availability of data and a growing appreciation for the importance of data-driven product design, there is a practical disconnect between the decisions being made for financial inclusion in Africa and the available data. This gap hinders the extent to which financial products and services meet the needs