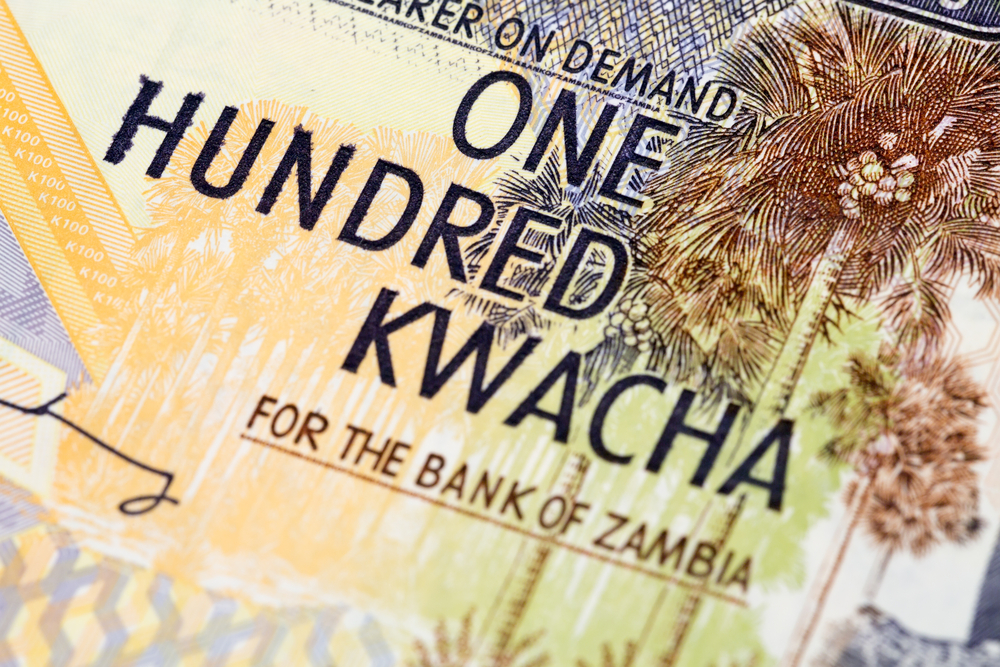

African digital platforms and the future of financial products

As societies and economies change, so should the financial products that serve them. Financial products help us manage our lives. They enable us to receive, store and spend money. The banking, mobile money, pensions and credit products we see have been shaped by the historical structure of our economies and