Finding partners in uncharted territory: How to harness network effects to build relationships when you’re starting from scratch

Finding partners in uncharted territory: How to harness network effects to build relationships when you’re starting from scratch

3 December, 2019 •Learning how to navigate a complex and changing stakeholder landscape is an essential skill for anyone in the social impact space. So, how do you go about identifying and building relationships with partners and stakeholders, particularly when you’re charting new geographic or thematic territory?

When I joined insight2impact just over four years ago, I walked into the brand-new position of community and partnerships manager in a new programme that would take our host organisations, Cenfri and FinMark Trust, to the forefront of the then-emerging field of data for good in the financial services sector.

Learning how to navigate a complex and changing stakeholder landscape is an essential skill for anyone in the social impact space. So, how do you go about identifying and building relationships with partners and stakeholders, particularly when you’re charting new geographic or thematic territory?

When I joined insight2impact just over four years ago, I walked into the brand-new position of community and partnerships manager in a new programme that would take our host organisations, Cenfri and FinMark Trust, to the forefront of the then-emerging field of data for good in the financial services sector. Being in a new position in a fast-moving field meant that I often found myself “where the maps end,” having to chart the path by walking it. And this was not a one-off experience: Over time, we would move into new territories, both thematic (e.g. the impact of the digital revolution on Africa) and geographic (e.g. Nigeria and South Africa). In true explorer style, we would reach the edge of our initial map only to see a new horizon unfolding before us. Each time we did, we needed to re-find our way in an evolving stakeholder landscape.

In the process, I learned an immense amount about identifying key actors and cultivating strong relationships with and among them. Some of these lessons follow below:

Finding partners in unfamiliar territory

A couple of years ago, one of our Advisory Panel members pointed out to us that we cannot work on data and the digital economy in Africa while ignoring a giant like Nigeria. We took that as a very good point and decided to plan an intensive outreach visit to the country. As part of the visit, we planned a number of convenings and events. The problem: Some of these were on emerging themes on which we haven’t engaged in-depth – and certainly not in a country as big and complex as Nigeria. So how were we to go about figuring out whom to invite and how to get them in the room?

The first thing we tried was to collate contacts from any previous engagements we and our colleagues have had, supplement these with a few “wish list” attendees (found via Google and LinkedIn – plus the author of an interesting blog), and send out invitations. And we got an RSVP rate of about 5%. While this wasn’t surprising, it wasn’t going to get us to where we needed to be. So, we went back, re-strategised and decided to try our hand at applying a couple of principles from network science to identify and engage stakeholders. And this worked exponentially better.

I’d like to share two of those network principles and how we applied them over the course of insight2impact.

The strength of weak ties (AKA the “friends of our friends’ strategy)

I often think back on a 1973 study by sociologist Mark Granovetter titled, “The Strength of Weak Ties.” My key takeaway from the study: If you’re looking for a new partner or a new job, you will most likely find it among your “weak ties” – i.e. the friends-of-your-friends. At two degrees of separation, people are different enough to you to open new opportunities (i.e. you don’t all know the same people, as is the case with a close-knit circle of friends), but still close enough that you likely have something in common. Also, you can harness social capital, for example, by having your mutual friend/colleague vouch for you.

In practical terms, when people ask if they can bring a friend or colleague to an event, I usually err on the side of saying “yes.” In fact, we sometimes explicitly ask people to bring along someone they think would be interested in the topic to an event. In Nigeria, for instance, we hosted a dinner for the people i2i had worked with to organize events in the country and asked each partner to bring along a guest. This made for interesting conversations and new connections.

Identifying key nodes in a network

Instead of spending hours reaching out or cold calling hundreds of strangers and semi-strangers (akin to our original, unsuccessful strategy), your time will be much better spent identifying key nodes/hubs in a network and building strong, mutually beneficial relationships with them. Network science often determines a node’s influence based on its connection to other influential nodes. For example, I would want the World Economic Forum’s website to link to my blog, because my association with an influential institution like WEF would greatly enhance my own influence (and would also improve my blog’s ranking in internet searches).

So, how do you go about identifying key nodes/hubs? Here are three methods we’ve used:

- Use your intuition: If much of what I said above sounds intuitive, that is because at a basic level, it is. Society is structured in networks of relationships, which we as humans navigate every day. This means that all you need to do to start, is to apply the principles above to identify well-connected and respected actors in the space you’re working in. This may be as much art as science, so let’s explore some more ideas.

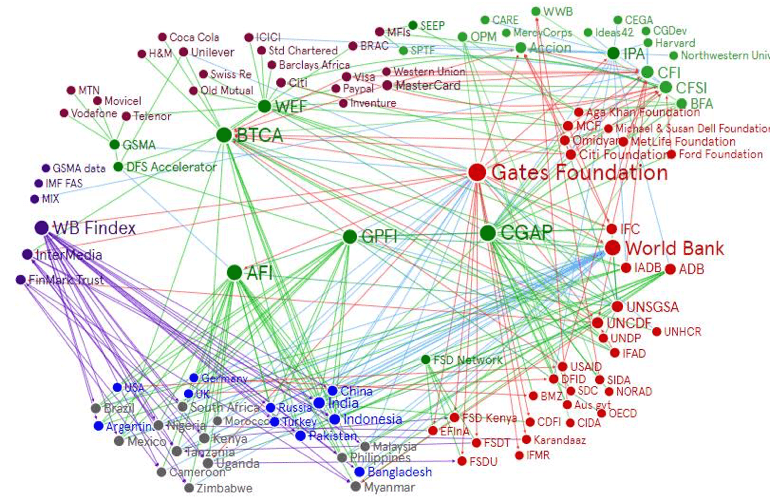

- Conduct manual stakeholder mapping: In the case of the financial inclusion measurement space, we manually started mapping the relationships we knew of among our stakeholders and then gradually built those out, based on desktop research. Figure 1 below is a screengrab of the resulting network map we used to inform our measurement engagement strategy. The relationships visualised here include both funding relationships and other types of collaboration and partnerships. Most network graph software packages also include interactive functionality to help you explore and navigate individual connections. This strategy allowed us to pinpoint partners to work with. For example, we specifically approached Mexico and Nigeria for pilot projects because of their demonstration potential: Both countries held key positions in the Alliance for Financial Inclusion’s Data Working Group and other global forums at that time. The map also shows the prominent role played by the Gates Foundation (the funder of this work).

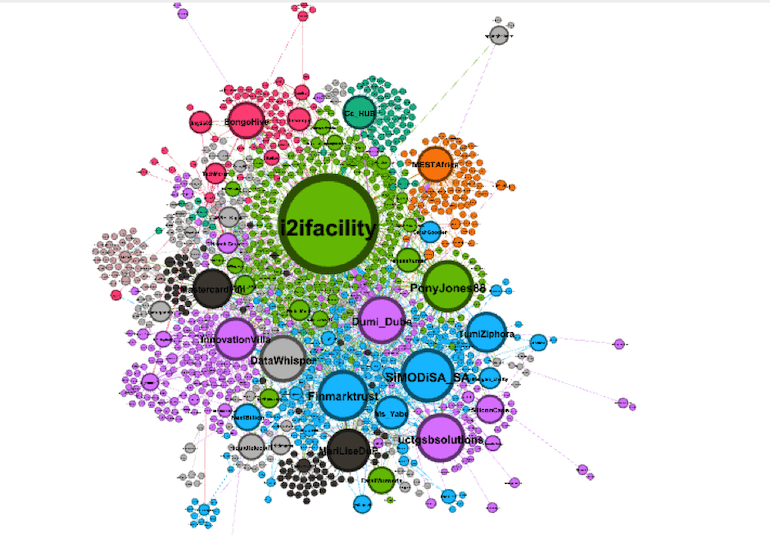

- Use data: After all, insight2impact is a programme focused on data and analytics, so it would be odd not to have applied some of that to our stakeholder engagement. For Figure 2 below, we scraped the hashtag for DataHack4FI – a data innovation competition we ran – and visualised it, then determined the influence of individual nodes and key conversation hubs.

This visualisation shows the prominence of our innovation hub partners (e.g. GSB Solution Space, SiMODiSA, Innovation Village, BongoHive, MEST Africa and CcHub) in the conversation. The Mastercard Foundation (the funder of this work) is also visible. And one can see that both organisations and individuals – e.g. Dumi_Dube, PonyJones88, MariLiseDuP (that’s me!), DataWhisper and TumiZiphora – can be hubs. In Uganda, we saw the role played by social media influencers: Tech bloggers emerged as hubs that helped make the Ugandan conversation one of the liveliest ones in the first year of the competition (Season 1). This successful strategy should be credited to Laboremus – our in-country implementation partner for DataHack4FI Season 1.

In practical terms, once you have identified these influential partners and gotten them on board, they will help attract the right people – especially if there is some shared interest and “skin in the game” (e.g. you’re co-hosting an event). The best partnerships also allow both sides to leverage each other’s reputation. This could entail, for example, reflecting partners prominently in branding and letting the partner who is best-known and trusted in the specific environment send the invitations. This approach worked very well for an event on digital payments we hosted with Lagos Business School and Data Science Nigeria – two key nodes in the Nigerian financial inclusion and data space.

The principles above have become part of our stakeholder engagement toolbox and approach at insight2impact. Four years on, I am amazed at the incredible people we are now privileged to call partners and friends, many of whom we didn’t know before – and some we wouldn’t have come across if we hadn’t tried something new. And as the financial and digital landscape in Africa keeps evolving, we’ll keep finding ways to map and make connections. Navigating a complex and changing external environment is always better in good company, after all.

This article was first published on Next Billion as part of the Openi2i series an initiative of Cenfri and Finmark Trust.