Policy options in a post-COVID-19 Africa

Policy options in a post-COVID-19 Africa

21 July, 2020 •A COVID-19 policy response framework to recover and adapt

COVID-19 is leaving no country unaffected. The global scale of the pandemic is affecting trade, capital flows, tourism and remittances, while lockdown or other measures[1] to contain the spread of the virus are affecting domestic output and livelihoods. Sub-Saharan Africa (SSA), where most economies were in a precarious position prior to COVID-19, is likely to be hit particularly hard. The UN Economic Commission for Africa (UNECA) estimates that, at best, Africa’s average GDP growth for 2020 will drop by 1.4 percentage points, with the worst-case scenario seeing Africa’s economy contracting by up to 2.6% and real per capita GDP dropping by 3.9%. The result is an estimated 5 million to 29 million people being pushed below the extreme poverty line, erasing five years of poverty reduction gains.

What can be done? For the development community and national policymakers, this creates a clear imperative: Wield whatever tools will be most effective to provide immediate relief and, more importantly, support longer-term adaptation to break the downward spiral. But this is easier said than done in SSA, where economies were already severely constrained before the crisis. Moreover: there will be no one size fits all solution. Different countries in SSA are impacted in different ways.

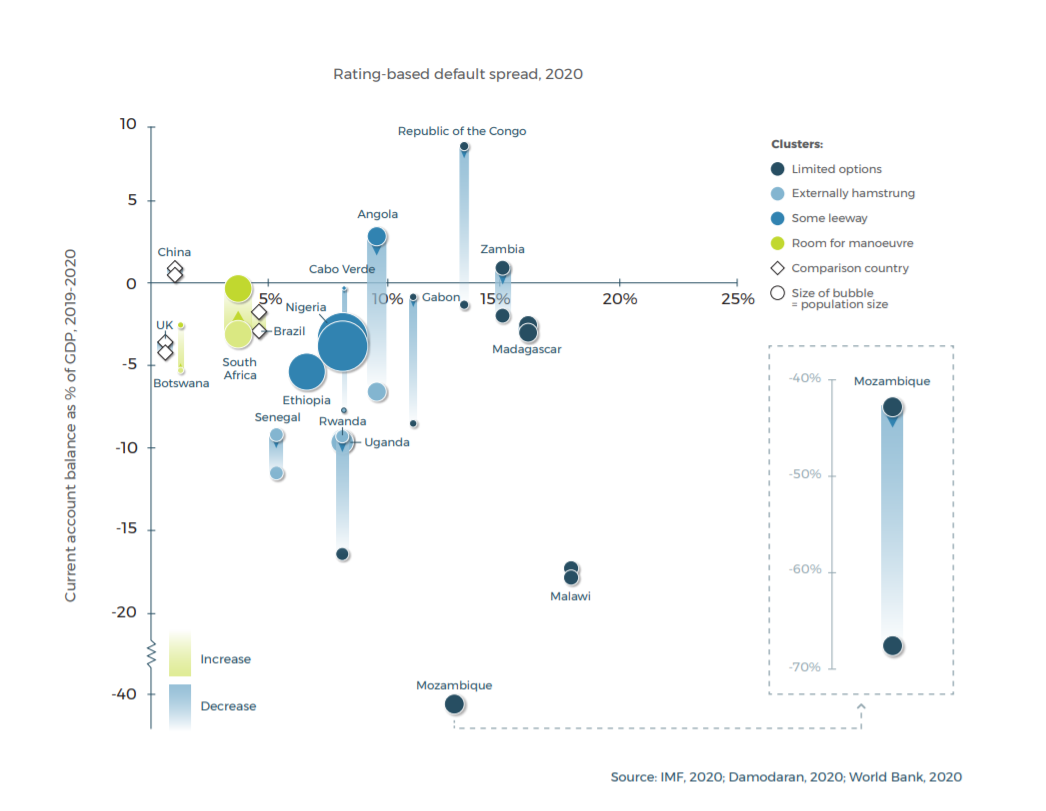

A sense-making framework: We’ve developed a framework to assist in thinking through how countries will be impacted based on three dimensions:

- The susceptibility of their economy to changes in the global economy – gauged via the current account position

- The fiscal ability to respond to the crisis – represented by the ability of the government to access finance.

- The ability of the domestic economy to bounce back – by looking at the competitiveness of the formal sector, as well as the role of the informal sector in supporting livelihoods.

Mapping economies in SSA across these three dimensions renders four clusters of countries across which to compare the likely implications of the pandemic.

For example, when comparing the first two dimensions, we see the following picture emerge:

A number of further factors will shape actual impact and policy options in any given country. Thus the framework is intended as a starting point to help policymakers and development partners understand the choices that they have in how they respond in country context across the next phases of the COVID-19 pandemic.

[1] By the end of April 2020, 17 countries in SSA had implemented a nationwide lockdown to curb the spread of COVID-19, 9 countries had implemented a localised or partial lockdown and a further 12 had implemented a night curfew.